Compensation Planning for 2026: HR Strategies for Deskless Teams

Compensation planning is entering a turning point. Inflation continues to chip away at take-home pay while most companies are budgeting only modest wage increases. At the same time, new pay transparency laws are spreading quickly and forcing employers to rethink how they publish and explain pay.

For HR leaders managing deskless teams such as manufacturing crews, logistics workers, and construction staff, these pressures land harder. Turnover is already high, and many of these workers do not have reliable email or internet access, which makes communication even tougher.

This guide walks through practical ways to design fair and flexible wage strategies that keep deskless employees engaged and productive. It will also show how to meet the unique needs of frontline teams while preparing for the compensation and compliance challenges of 2026.

Build Pay Structures Around Skills, Not Just Roles

Paying for skills instead of titles gives you a sharper way to reward frontline talent. When wages rise each time a worker proves a new capability (such as mastering a CNC machine or earning a forklift license), people see a clear path to better pay. That visibility matters; skill-based ladders help cut turnover because employees stay to earn the next bump.

Tie every increase to something concrete. Certifications, on-the-job assessments, or hours logged on critical equipment all work. Add small bonuses on top of existing pay so a safety certification can stack with a bilingual bonus without replacing it. The same approach works for shift premiums: overnight, weekend, or hazardous assignments earn either a flat hourly bonus or a percentage increase, giving workers a solid reason to volunteer for tougher slots.

Clarity makes the difference. Publish a wage chart on break-room boards and consider distributing it via text, allowing employees to access it on their phones. A mobile-first experience lets a line worker check where they sit and what they need for the next raise without hunting for a computer.

Here's a simple roadmap you can implement:

- List each core role and the baseline wage

- Define three to five skill levels, each with clear requirements

- Assign a dollar or percentage increase to every level

- Add separate columns for shift bonuses and additional certifications

- Review the chart twice a year and update it in the same place employees already look

Make progression easy to track. Digital systems log completed courses and notify payroll automatically when a worker qualifies. When combined with plain-language approaches, you get a pay system that feels fair, transparent and worth the effort.

Link Compensation to Retention and Turnover Metrics

Losing a forklift driver or journeyman carpenter doesn't just leave a gap on the schedule, but it drains cash, too. When you connect wages to retention metrics, the financial picture becomes crystal clear, helping you invest in staying power instead of constant rehiring.

Start by calculating what churn costs your operation. Every departure brings recruiting fees, paid training hours and overtime for teammates covering the gap. You also face productivity drops while newcomers get up to speed, a reality many manufacturing and logistics teams know all too well.

- Create a simple worksheet that multiplies each cost by your actual numbers from the last quarter. Even rough estimates usually prove that preventing one resignation costs far less than filling it. This data becomes your business case for retention-focused pay.

- Build a pay ladder that rewards longevity. Many HR teams add a 2–3% wage bump at the one-year mark, 4–5% at three years and another premium at five. Layer in small anniversary bonuses or an extra paid day off to make milestones feel tangible. Since you're spreading the spend over time, the hit to your wage budget increase stays below 3.5% overall.

- Use your HRIS to spot trouble before it spreads. If turnover on the weekend shift runs higher than the company average, dig into pay differentials and adjust premiums quickly.

- Overlay retention dashboards with referral data: workers hired through peers often stay longer, so fund referral bonuses out of the savings from lower churn.

- Communicate the value of longevity pay clearly. Post wage-tier charts in break rooms and send short SMS updates during pay-period closeouts. Two-way channels let employees ask questions immediately, turning a line item in the budget into a concrete reason to stay for the next shift and the next year.

The result is a pay strategy that not only controls costs but also builds a stronger, more loyal workforce.

Balance Base Wages with Performance Incentives

Start with a solid wage foundation, then layer incentives that your crews can see and influence. This mix keeps production high, accidents low, and turnover manageable.

Productivity incentives work best when they're simple and visible. In a warehouse, you might bonus every picker who clears 120 orders per shift. For drivers, focus on on-time deliveries. Choose numbers your people control and track them openly. A simple poster or SMS leaderboard beats a complicated dashboard that most staff will never check. When workers know the target and can watch their progress, output climbs naturally.

Safety deserves its own rewards. Try a small weekly bonus for individual accident-free days, plus a larger quarterly payout tied to your team's overall incident rates. This rewards personal care while encouraging crews to look out for each other. Offer extra credit for completing new safety certifications, which helps reinforce training and reduce claims.

Split incentives between individual and team performance to keep your top performers motivated without hurting teamwork. For example, base 60% of a bonus on personal numbers and 40% on the shift's collective results. This prevents the "lone wolf" mentality that can damage purely individual systems.

Timing matters more than you think. A bonus paid four weeks late feels like an afterthought. Release earned incentives on the next paycheck or through on-demand pay tools so workers feel the reward right away.

Personalize recognition whenever possible. Some workers prefer cash, others value an extra day off or a branded tool kit. Quick pulse surveys reveal these preferences and show that you respect individual needs — an easy trust win that costs nothing but pays back in loyalty.

Address Pay Transparency and Compliance Early

Pay transparency laws are expanding rapidly. Eleven states now require public wage ranges, and more states will follow by 2026. For frontline teams, that brings new challenges: formal job postings must list the range, but informal ads and less conventional channels often don’t fall under the same rules.

Start by organizing your wage structure clearly. While we are not legal professionals, industry best practices suggest that frontline employers can avoid fines by publishing consistent wage information everywhere jobs appear. In that context, you can use this checklist to help you stay compliant:

- Map each role to a market wage range and review it every 12 months

- Add that range to all job ads, shift bids and promotion notices

- Spell out shift premiums for night, weekend and hazardous work alongside base rates

- List key perks like health coverage and tool stipends since some states view benefits as part of total compensation

- Post the same information in break rooms, text updates and onboarding packets so workers without email access can see it

Numbers alone don't build understanding. You need clear explanations of how wages increase. Translate pay ranges and step increases into the top two or three languages your crews speak. Deliver this information through SMS or printed handouts rather than email. Brief "how pay works" conversations at the start of shifts work better than lengthy documents.

Document everything carefully. Keep a current spreadsheet of wage ranges, signed manager approvals for pay increases and dated copies of every job posting. This preparation makes audits straightforward. Run a yearly self-audit against compliance requirements to catch problems before regulators do.

Transparency builds trust with your workforce. When you publish fair ranges and explain them clearly, workers see proof that pay decisions are equitable. This approach reduces workplace rumors and strengthens morale, especially for employees who often feel disconnected from headquarters decisions.

Adapt Benefits to Deskless Workforce Needs

When wages alone can't keep every transportation worker or site crew member onboard, the right benefits make all the difference. The key is choosing practical support that fits how shift workers live and work.

Start with scheduling flexibility. Give people control over their shifts through simple swap and pickup options. When workers can trade shifts easily, you stay covered while respecting their personal time. Self-scheduling cuts last-minute absences and reduces overtime costs.

Healthcare needs to work around shift schedules, not the other way around. Telehealth visits, pop-up clinics right in the loading bay and quarterly mobile screenings remove the biggest barrier: "I don't have time." This matters especially for workers on 12-hour rotations who can't easily get to a doctor's office during regular hours.

Financial stress hits shift workers hard, but you can help. Early wage access lets people tap their earned pay mid-cycle instead of relying on expensive payday loans. Add some budgeting classes, and you tackle another major pain point. Workers with better financial stability show up more consistently.

Industry-specific perks show you understand their daily reality. Consider these targeted benefits that address real expenses workers face every day:

- Logistics teams need bus passes or fuel cards

- Construction crews want tool stipends

- Manufacturing workers appreciate uniform allowances that cover replacement costs

- All frontline staff benefit from flexible Lifestyle Spending Accounts (LSAs)

These targeted supports feel generous because they remove actual costs from workers' budgets.

For maximum impact, consider Lifestyle Spending Accounts (LSA). An LSA gives each employee a monthly stipend to spend how they choose: one worker might pay for childcare, another for gym fees.

Make sure people know about these benefits. Post clear explanations in break rooms and send updates by text. When workers understand what's available and how to use it, your benefits become a compelling reason to stay.

Plan for Inflation and Rising Costs

Build your 2026 wage strategy with realistic projections in mind. Consumer prices are forecast to rise about 2.7%, while total base pay should increase by 3.5%, maintaining a competitive edge in the labor market.

Benchmark your hourly rates twice a year: January to catch minimum-wage resets and July to gauge mid-year labor market shifts. This six-month cycle keeps you ahead of regional spikes instead of scrambling after you've lost good people to competitors.

Build cost-of-living adjustments (COLA) directly into your policy. A 1–3% COLA tied to publicly posted Consumer Price Index (CPI) data works for most frontline roles. Keep in mind that even a 1% bump on a $20 million payroll adds $200,000, so document the financial impact before you commit. Pair the COLA with merit increases so your best performers still see meaningful differentiation.

Since economic conditions can swing unexpectedly, model at least three budget scenarios:

- Baseline (2.7% CPI)

- Elevated (4%)

- Stretch (5%+)

For each scenario, decide how much goes to permanent base wages versus one-time payments. Lump payments protect your long-term wage structure if prices cool down, while flat-dollar raises help lower-paid workers feel the increase more than a straight percentage would.

Explain the math to your teams. Short, clear updates during shift changes or via text should cover why prices matter, how the COLA works and when the next review happens. When employees understand the link between economic trends and their pay, they're less likely to assume you're just "cutting costs" and more likely to stick with you through the next economic swing.

Strengthen Compensation with Better Communication

Clear pay communication builds the trust and stability your frontline teams need. When workers understand their wage tiers, skill bonuses and benefits in simple terms, confusion disappears and turnover drops. The strategies we covered: skill-based pay increases, transparent wage ranges, tailored benefits and inflation-ready budgets work best when every worker knows exactly what they mean.

Reaching workers with this information presents a real challenge. Most never check email, and many work shifts make face-to-face meetings impossible. Text messaging solves this problem by meeting workers where they are: on their phones.

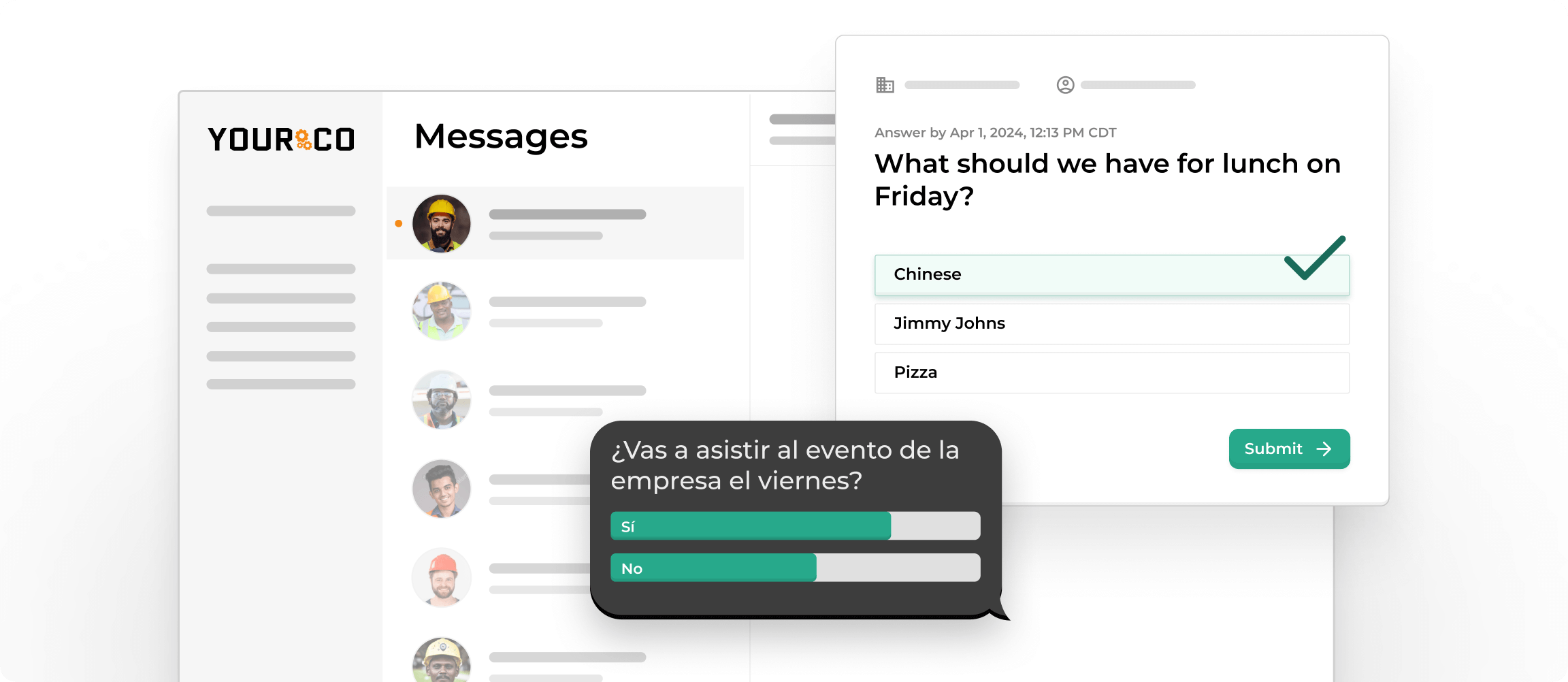

Yourco's SMS platform makes complex information simple and accessible. You can instantly notify teams about new wage tiers, send reminders about upcoming longevity bonuses or answer questions about benefit deadlines. Messages arrive in each worker's preferred language, removing communication barriers that often leave employees confused about their pay.

Two-way messaging lets workers ask questions and get immediate answers, while delivery tracking shows you exactly who received each update. Whether you're explaining a safety bonus program or announcing cost-of-living adjustments, Yourco ensures every message reaches its target and drives understanding.

Ready to make every pay update reach your entire team? Try Yourco for free today or schedule a demo and see the difference the right workplace communication solution can make in your company.

Frequently Asked Questions

Why is wage planning different for frontline teams?

These workers face unique challenges like rotating shifts, physical demands and limited computer access. When pay falls behind or communication breaks down, people leave quickly. The deskless workforce faces pressures that make standard pay approaches less effective.

How can HR link pay to safety outcomes?

Tie bonuses to accident-free days, completing safety training, or getting certified on equipment. Post results where everyone can see them and pay weekly, so safety stays front of mind. These targeted approaches show measurable results.

What role does communication play in wage planning?

Clear pay messages build trust and help workers understand their full earnings. SMS platforms like Yourco reach every phone right away, ensuring frontline teams get the same information as office workers.

How can companies prepare for 2026 transparency laws?

Start tracking pay ranges now, include them in job posts and keep records of any changes. While we are not legal professionals, following practical preparation helps you stay ready.

Can non-cash benefits really impact retention?

Yes. Early wage access, uniform allowances and flexible Lifestyle Spending Accounts reduce daily stress and often matter more than small raises, keeping people on your team longer.